Breaking Down the Walls: The Key Differences Between Traditional Finance (CeFi) and Decentralized Finance (DeFi)

FINTECH, learn

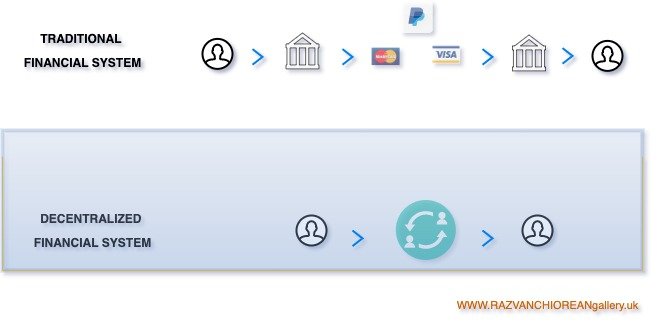

Welcome to the ultimate showdown between traditional finance and decentralized finance in one corner, we have the long-established financial system, also called traditional finance (CeFi), with its brick-and-mortar banks and legacy infrastructure. In the other corner, we have the new kid on the block, decentralised finance (DeFi), with its promise of open, transparent and borderless financial services.

The battle between these two approaches to finance is heating up, with each side vying for dominance in the ever-evolving world of money. So, buckle up and get ready to explore the differences and drawbacks of traditional finance and DeFi in this exciting easy to read post.

What is Decentralized Finance?

Decentralized finance (DeFi) is a financial system built on top of a network called blockchain that aims to provide an open, transparent and permissionless technology for its platform to run financial services without the need for intermediaries such as banks or other financial institutions (read more here). In a decentralized finance system (DeFi) users can access a range of financial services such as lending, borrowing, trading or investing using digital assets, mostly cryptocurrencies, without having to rely on centralized entities or intermediaries. Instead, transactions are processed using smart contracts, which are self-executing programs that run on the blockchain.

In a decentralized finance system (DeFi) users can access a range of financial services such as lending, borrowing, trading or investing using digital assets, mostly cryptocurrencies, without having to rely on centralized entities or intermediaries.

What’s the beauty of decentralized finance (DeFi) systems? They operate on a 24/7/365 basis, meaning they do not have any restrictions on when users can access their funds or perform transactions. This decentralized nature of DeFi provides users with greater financial autonomy and control over their assets, as well as increased transparency and security. Some popular DeFi applications include decentralized exchanges (DEXs), where users can trade cryptocurrencies directly with each other without the need for a centralized exchange and lending platforms, where users can borrow or lend digital assets without the need for traditional intermediaries such as banks.

SUMMARY

Overall, DeFi is seen as an innovative and promising development in the world of finance, with the potential to disrupt traditional financial systems and provide greater financial inclusion and access to financial services for people around the world.

What is Traditional Finance?

A centralized financial (CeFi) system or traditional is how is well known by the general public is a sum of all instruments and institutions that deals with the management of money and investments using conventional methods. Traditional finance focuses on the use of financial products such as stocks, bonds, mutual funds and insurance products to help individuals and organizations achieve their financial goals.

It is based on the principles of risk, return and the goal is to maximize returns while minimizing risk. Traditional finance is also characterized by its reliance on financial intermediaries such as banks, brokers and insurance companies, third party institutions that play an essential role in the financial system by providing access to financial products and services and by facilitating the flow of funds between borrowers and lenders.

SUMMARY

Overall, traditional finance provides a framework for understanding and managing financial transactions and investments using established methods and techniques. It continues to be an important field of study and practice in the modern financial world along with the innovations from the fintech sector.

What Are The Differences Between CeFi And DeFi?

Two distinct financial systems that differ in various aspects, including:

1. Decentralization: The primary difference between DeFi and CeFi is that DeFi is a decentralized financial system, while CeFi is centralized. In DeFi, the financial transactions occur on a decentralized network called blockchain without intermediaries, whereas CeFi is based on a centralized platform or entity.

2. Access: DeFi is open to anyone with an internet connection, while CeFi requires users to go through a vetting process that may involve submitting identification documents and undergoing Know Your Customer (KYC) procedures, or even disposing a minimum amount of money for opening an account.

3. Control: In DeFi, users have control over their assets and can manage them directly. In contrast, CeFi platforms control users' assets and users must trust the platform to keep their assets secure.

4. Transparency: DeFi is more transparent than CeFi, as transactions on the blockchain network are publicly visible, whereas CeFi may have restrictions on access to data or information.

5. Speed: CeFi transactions tend to be faster than DeFi transactions since the latter requires consensus among network participants, leading to longer processing times.

6. Fees: DeFi transactions can be cheaper than CeFi transactions since they don't require intermediaries like banks or payment processors that charge fees.

SUMMARY

DeFi is decentralized, open, transparent and more interoperable but has longer processing times and may require more technical expertise, while CeFi is centralized, requires KYC procedures and may have restrictions on access to data but can be faster and more user-friendly.

The Future of DeFi

Decentralized finance or DeFi, is a rapidly growing ecosystem of financial applications built on top of blockchain technology. DeFi applications are designed to be transparent, accessible and trustless, meaning they operate without the need for intermediaries such as banks or other financial institutions. Instead, DeFi protocols use smart contracts, which are self-executing programs that automatically enforce the rules of the protocol.

As DeFi grows, we may see it integrate more closely with traditional finance. This could involve the creation of hybrid financial products that combine the best of both worlds, such as decentralized lending and traditional underwriting.

The Bottom Line

As the demand for more accessible and decentralized financial products and services continues to grow, and the ecosystem continues to evolve, we already see DeFi as an even more important part of the global financial system than it used to be three years ago from which people speculate and benefit. What is your experience with DeFi products? Join the conversation: Your voice matters! Share your thoughts and opinions in the comments below and let’s start learning from each other.

We hope you enjoyed this post about traditional finance vs decentralized finance.

About the Author

Razvan Chiorean is a published author of compoundY and a cutting-edge researcher in quantum computing, AI-ML, and blockchain technology. Through his #AIResearch handle, Razvan continues to conduct research, blog, and educate, bridging cultures and inspiring technological progress while consistently sharing his findings and insights. He collaborates with leading tech companies, contributes to open-source projects, and is dedicated to fostering ethical standards and inclusivity in technology, ensuring a future where advancements benefit everyone.

✩✩✩

Related Posts

Get Ready for Web3.0

Web3 offers powerful benefits for both business and personal use, giving you a competitive edge in today's rapidly evolving digital world.

Join us at Quantum.Tech Europe as we bring together the quantum ecosystem to Twickenham

Stadium, London on 23 rd – 25 th September, 2024!

Don’t miss your chance to network, learn and debate with 400+ attendees! Get 20% off with code COMPOUNDY20 here

Quantum Fundamentals

Through Ledger steadfast products and features, you can safely interact with your assets in one place.

Recommended Books

Blockchain Inspired Art

Traditional COMPOUND interest helps your money grow through reinvested returns. Web3 technology takes this principle further, offering enhanced opportunities through peer-to-peer networks. Discover how combining smart investing with blockchain technology can accelerate your wealth building potential.

Composition

Mixed media on canvas

Wood frame

100 X 70 CM

39.5 x 27.5 inches

1.5cm deep

0.6 inches deep

Wellness in Motion

In a world increasingly dominated by technology and convenience, finding balance is no longer a luxury—it's essential.

Analysis of Cosmos Network’s top promising projects. From tokenomics, to developer activity, and growth outlook—giving UK readers key insights on blockchain interoperability and most exciting use cases.